In the dynamic world of international transport and logistics, ensuring the safe and secure delivery of goods is of paramount importance. This is where CMR insurance comes into play, offering a crucial layer of protection for businesses engaged in cross-border freight transport.

In this comprehensive guide, we’ll explore the intricacies of CMR insurance, from its origins and purpose to the critical aspects of coverage, and how it can safeguard your interests in an increasingly interconnected global marketplace.

What is CMR insurance?

CMR insurance, also known as CMR transport insurance, is a type of insurance that provides coverage for goods transported internationally by road. This insurance protects everyone involved in shipping goods across borders.

The “CMR Convention” is an international agreement that governs the transportation of goods between different countries by road. The abbreviation CMR stands for “Convention on the Contract for the International Carriage of Goods by Road.” This agreement ensures that the rules for moving goods by road between countries are consistent and provide legal protection for all parties involved in the process.

CMR insurance is like a safety net. It helps cover financial losses if something goes wrong during the transport. That applies to trucking companies, people receiving the goods, and anyone else involved in the process.

Understand CMR insurance

Now that we’ve introduced the concept of CMR insurance let’s take a closer look at what it involves.

Brief history of CMR

The CMR Convention was created in 1956. It was established under the United Nations Economic Commission for Europe (UNECE), making it an international treaty.

The primary purpose of the CMR Convention was to provide a standardized framework for international road transportation. Before the CMR Convention, there were various rules in different countries. That caused confusion and disputes when goods crossed borders. The CMR Convention aimed to simplify and harmonize these rules. It made transporting goods by road internationally much easier.

The CMR Convention was adopted by a group of countries that saw the need for a standard set of rules governing international road transportation. These countries recognized that a standardized system would benefit everyone involved in transport.

What is the purpose of CMR insurance?

CMR insurance aims to financially protect and follow the law for people and businesses involved in international road shipping. Its mechanisms serve to help with unexpected problems and losses:

-

Financial protection

CMR insurance helps protect the money of people and businesses involved in international road transport. It covers financial losses if goods get damaged, stolen, or similar during the journey.

-

Following the rules

Using CMR insurance helps trucking companies and shippers follow the law. In many countries, it’s required to have insurance for goods transported internationally by road. CMR insurance makes sure everyone follows these rules.

-

Reducing risks

International road transport can be risky with theft or damage to goods. CMR insurance helps lessen these risks by providing a safety cushion. That allows businesses to work with confidence.

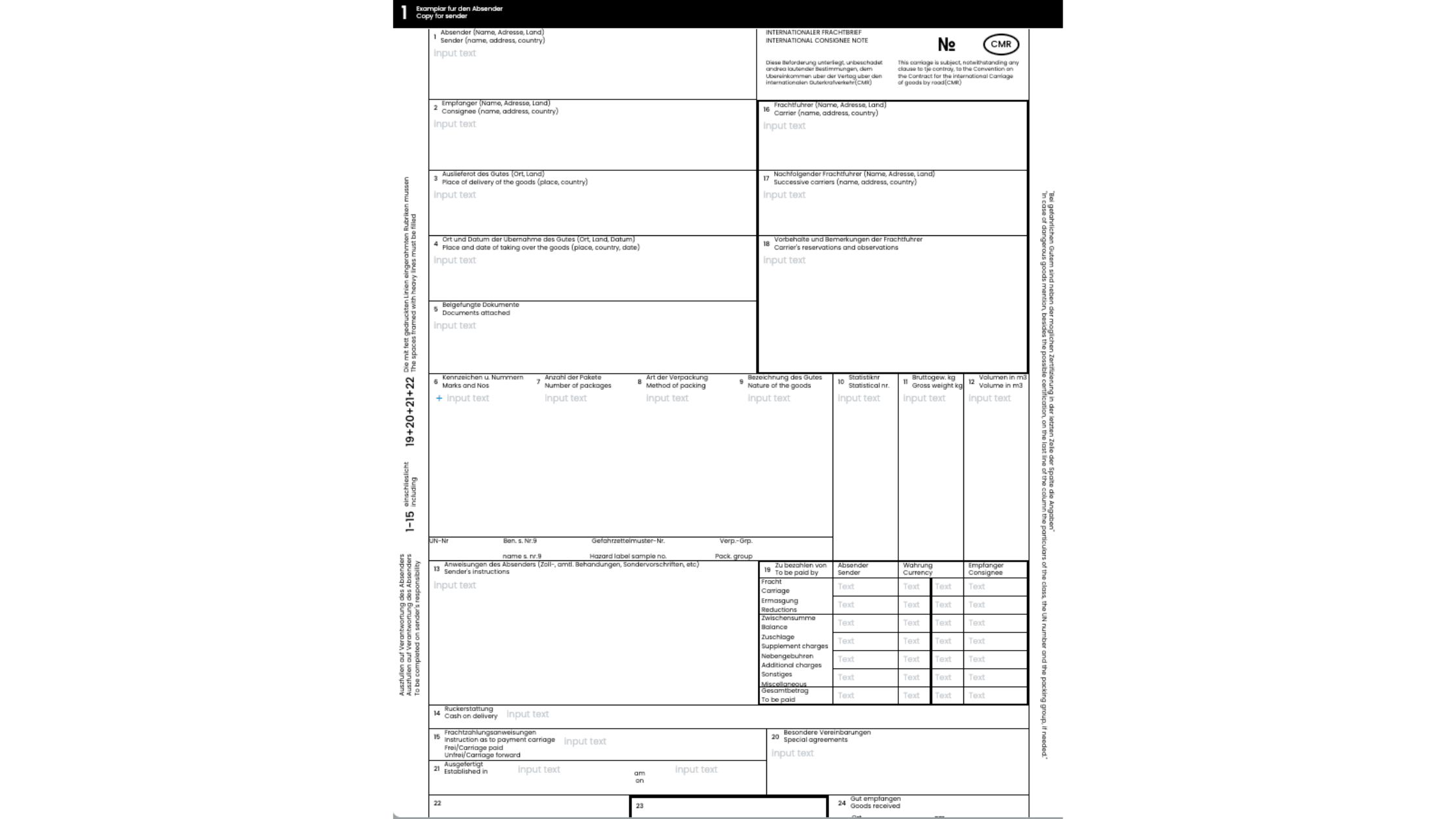

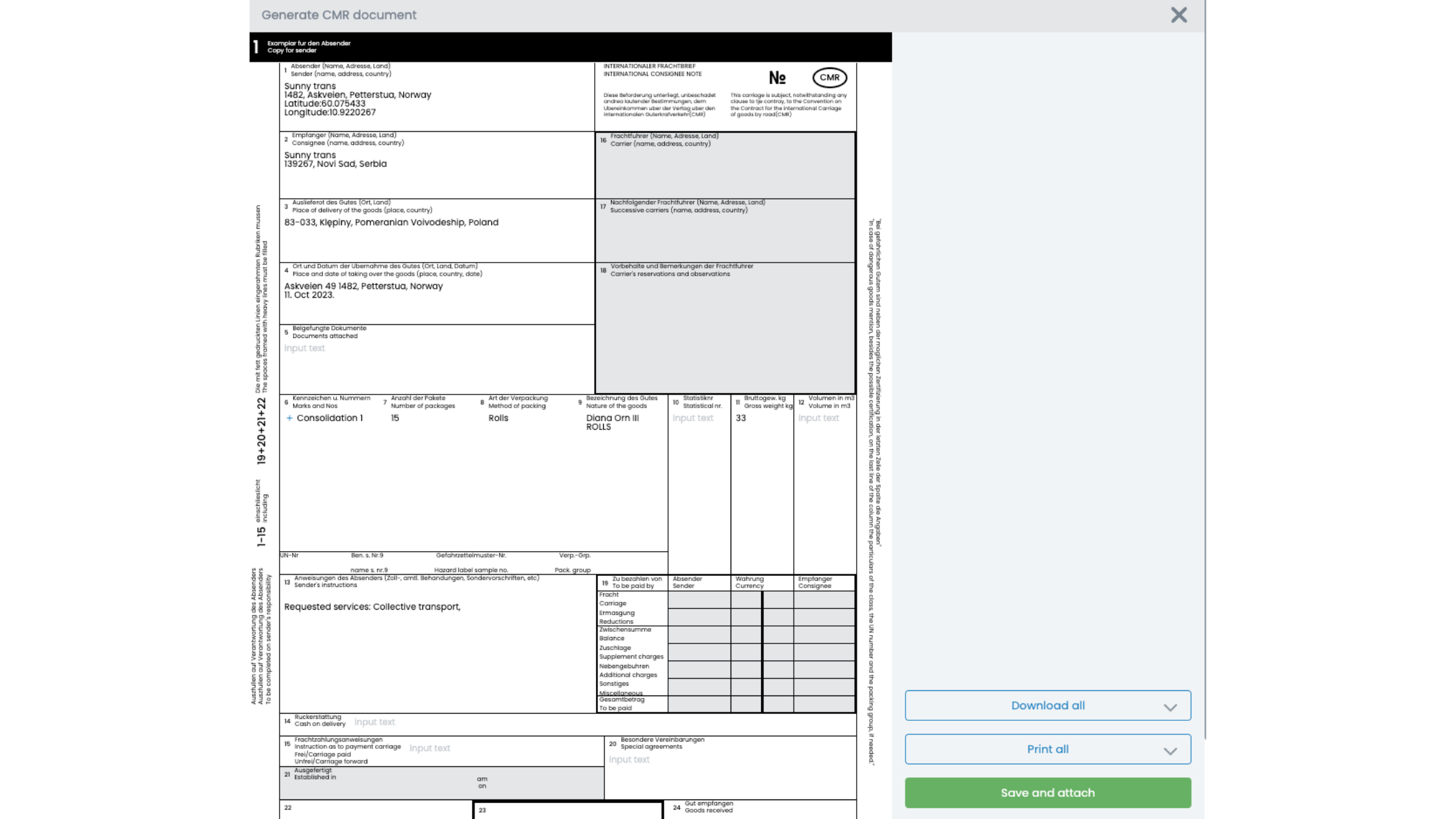

What does a CMR look like?

A CMR contains all the important details about the shipment to ensure everything goes according to plan. Here’s a list of what you’ll find on a CMR:

1. Sender’s information:

This includes the name and address of the person or company sending the goods.

2. Consignee’s information:

It tells us who receives the goods and where they should be delivered.

3. Carrier’s details:

This section has information about the company responsible for transporting the goods.

4. Description of goods:

It describes the goods’ quantity and any unique characteristics.

5. Terms of the contract:

This part shows the conditions and terms agreed upon for transporting the goods.

6. Instructions:

Any specific instructions related to the handling or delivery of the goods.

7. Signatures:

The sender signs the CMR, and the carrier confirms the acceptance of the goods.

8. Seals and marks:

Details about any seals or marks used to secure the goods during transit.

9. Date and place:

The date when the CMR is issued and the place from where the goods are starting their journey.

10. Additional notes:

Any additional information relevant to the shipment may also be included.

What are the rules of CMR?

CMR rules are guidelines for international road transport. They ensure its safety and set limits on who is responsible for any potential damage. CMR rules are a mechanism that companies stick to when they need to solve these types of problems. CMR rules are:

1. Safety first:

The safety of the goods and people involved in transport is a top priority. Everything must be done to ensure safe transportation.

2. Delivery obligation:

The carrier is responsible for delivering the goods to the consignee. The goods must arrive in the condition they were received unless otherwise stated.

3. Delivery time:

Goods must be delivered within the agreed-upon timeframe. If no timeframe is specified, the delivery should be made within a reasonable time.

4. Loss or damage:

The carrier is generally responsible if goods are damaged or lost during transportation.

5. Liability limits:

CMR limits the compensation the carrier has to pay for damaged or lost goods.

6. Proper documentation:

All the necessary documents (including the CMR) must be correctly filled out and provided.

7. Claims:

If there are issues with the shipment, the parties involved should make claims promptly. There is usually a set timeframe for these claims.

8. Dispute resolution:

Disputes related to CMR contracts are resolved through arbitration or court proceedings.

What does CMR cover?

CMR insurance covers:

- damaged or lost goods;

- theft;

- accidents;

- other unforeseen events;

If the goods get damaged or lost during transport, CMR insurance can help cover the cost. On some occasions, the goods can get stolen while in transit. In that case, CMR insurance can provide financial protection.

Likewise, CMR insurance can help with the losses if an accident happens. Finally, CMR insurance may also cover unexpected events that can impact the goods during transportation.

What CMR doesn’t cover?

While CMR insurance provides essential protection, it doesn’t cover everything. Here are some things CMR insurance typically doesn’t cover:

1. Goods not listed

If the goods being transported aren’t listed on the CMR document, they may not be covered.

2. Delay in delivery

CMR insurance usually doesn’t cover financial losses due to delivery delays. That doesn’t apply if specific arrangements are made.

3. Damages due to improper packing

If the goods were not packed correctly and this led to damage, CMR insurance might not cover it.

4. Damage caused by the goods themselves

If the goods being transported are harmful or cause damage to other goods, this might not be covered.

5. Certain types of goods

Some types of goods, like valuables or hazardous materials, require separate insurance as they could fall outside the scope of CMR insurance.

What are the carriers’ liabilities regarding CMR?

Carriers’ responsibilities under CMR include safe transportation, delivering goods intact, and taking responsibility for any damage or loss during transit, subject to compensation limits set by CMR rules.

The primary responsibility of carriers is securing the safe transportation of goods. To do so, they must use suitable vehicles for transport. They should also secure and handle the goods correctly when loading and unloading them. Doing so will prevent things like theft or damage during transit.

Carriers must deliver the goods in the same condition as they received them. This is mandatory unless the damage is proven to be beyond their control. However, if goods get damaged or lost, and it’s the carrier’s fault, they must compensate the sender or consignee. In that case, CMR may limit its liability to a certain amount.

Carriers also must accurately fill out the CMR document. That means providing correct information about the goods, sender, and all other details. If they don’t do so, they may face legal issues.

Carriers are obligated to report any damage, loss, or delay to the sender or consignee on time. Doing so will allow all parties to react promptly.

CMR limits the amount carriers are liable to pay for damaged or lost goods. These limits can vary depending on many factors. The most common one is to set the amount per kilogram or gross weight of the goods.

There are situations where carriers may be exempt from liability. That includes situations like:

- situations out of their control;

- when goods are prone to damage due to their nature;

- reacting to emergencies to save lives or protect property.

Do shippers have some liabilities regarding CMR?

Shippers have liabilities under CMR, like providing accurate documentation, proper packaging, and timely notification of issues. That guarantees safe and compliant international road transportation.

Shippers must first provide accurate and complete information on the CMR document. That includes details about the goods, sender, and consignee. Any mistakes can lead to legal issues and liability.

Next, shippers must check if the goods are properly packaged and prepared for transportation. If the goods aren’t correctly packaged, which causes them to get damaged, they can be liable.

Shippers also must notify the carrier about any special requirements or handling instructions. By doing so, they’ll prevent damage from happening.

They should quickly report any shipment-related issues to the carrier. Timely communication helps resolve problems and avoid further liability.

Shippers must adhere to the terms and conditions in the CMR contract. If not, they’ll be responsible for any issues or losses.

Shippers should be aware of the liability limits set by CMR regulations. If goods are lost or damaged, the compensation may be subject to these limits, and shippers must understand how they apply.

Finally, shippers should know about the rules that limit how much compensation they can get if their goods are lost or damaged during transportation.

FAQ about CMR note

1. Who issues the CMR note?

The carrier or the trucking company typically issues the CMR note.

2. Who fills in the CMR note?

Usually, the driver and sender representatives fill out the CMR form manually.

3. Who signs CMR?

Both the sender and the carrier sign the CMR note.

4. How many copies of the CMR note do I need?

You generally need at least three copies of the CMR note.

5. What is the limit of CMR insurance?

The limit of CMR insurance can vary but is often based on the weight of the goods.

6. What is the difference between a CMR note and a Bill of lading?

A CMR note is for road transportation, while a Bill of Lading is mainly for sea or ocean shipments. Still, they both serve as proof of the contract and receipt of goods.

Generate CMR automatically

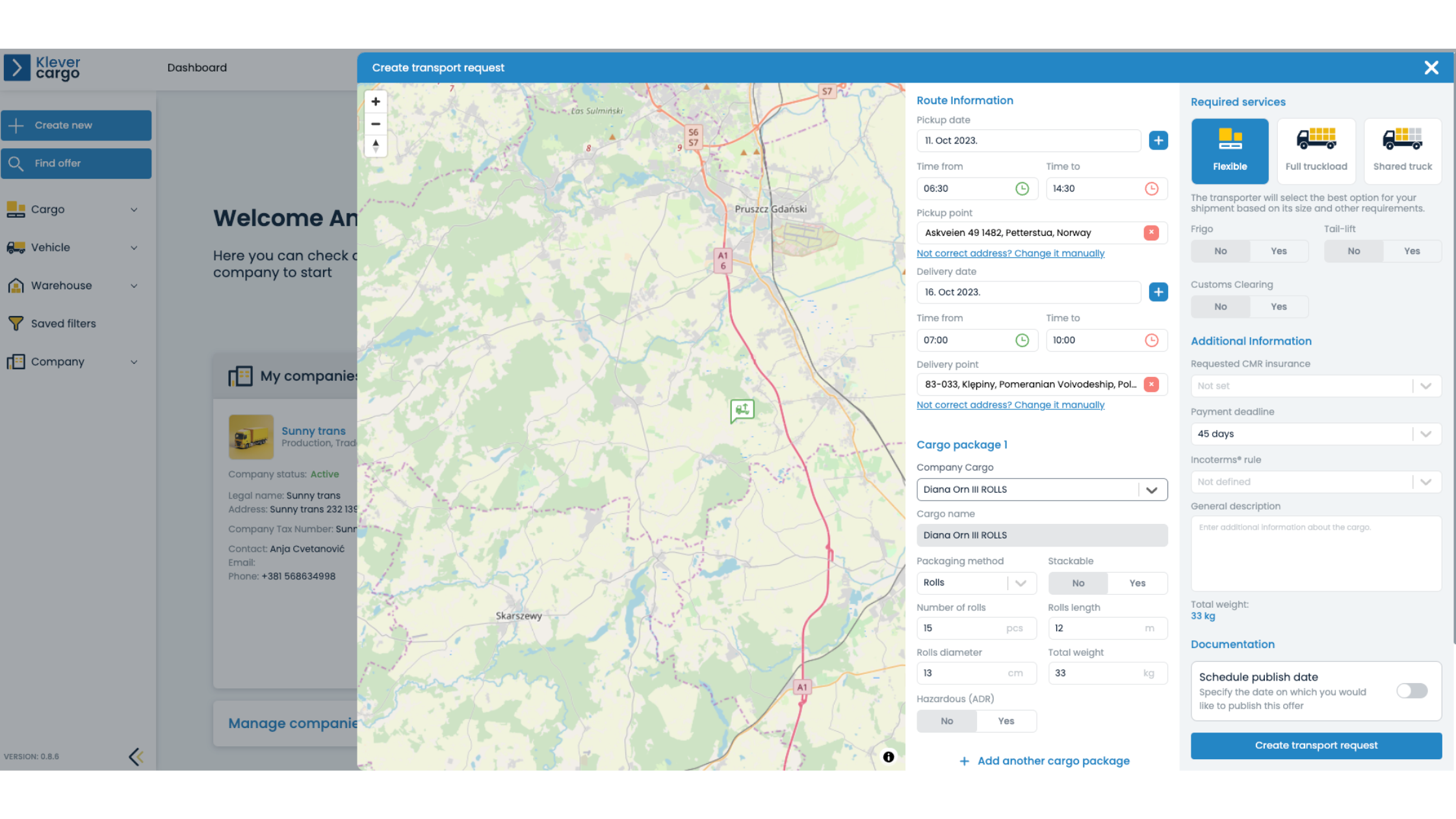

The KleverCargo platform offers a convenient solution for shippers, freight forwarders, importers, exporters, and anyone in need of organizing the transportation of goods. Here’s how they can use it to post transport requests and automatically generate CMR documents:

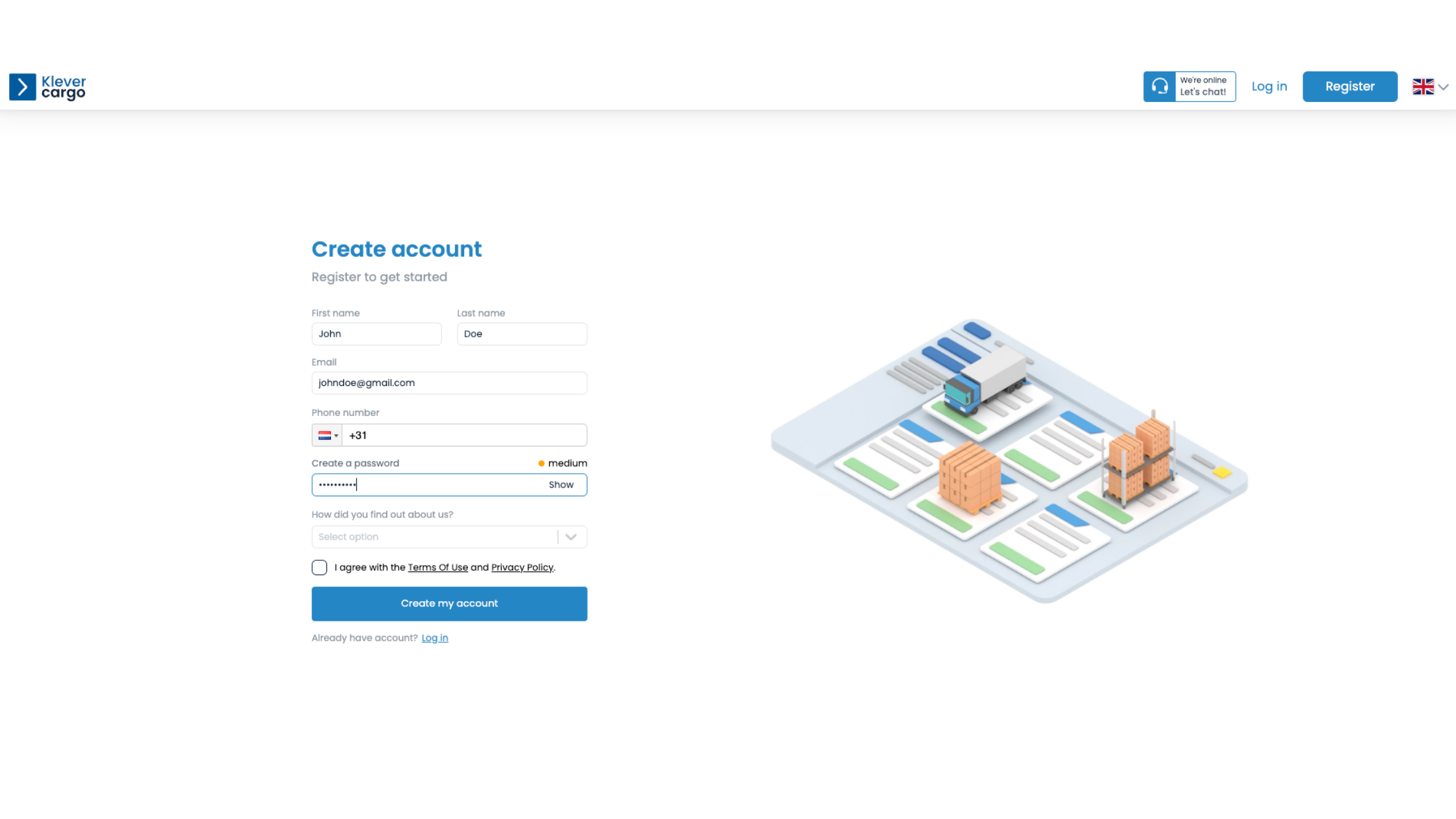

- Accessing KleverCargo:

Users can access the KleverCargo platform through web browser or phone. It’s user-friendly and doesn’t require advanced technical skills.

- Registration and profile creation:

To get started, users need to register on the platform by providing basic information. They can create a profile, which helps streamline the booking process for future shipments.

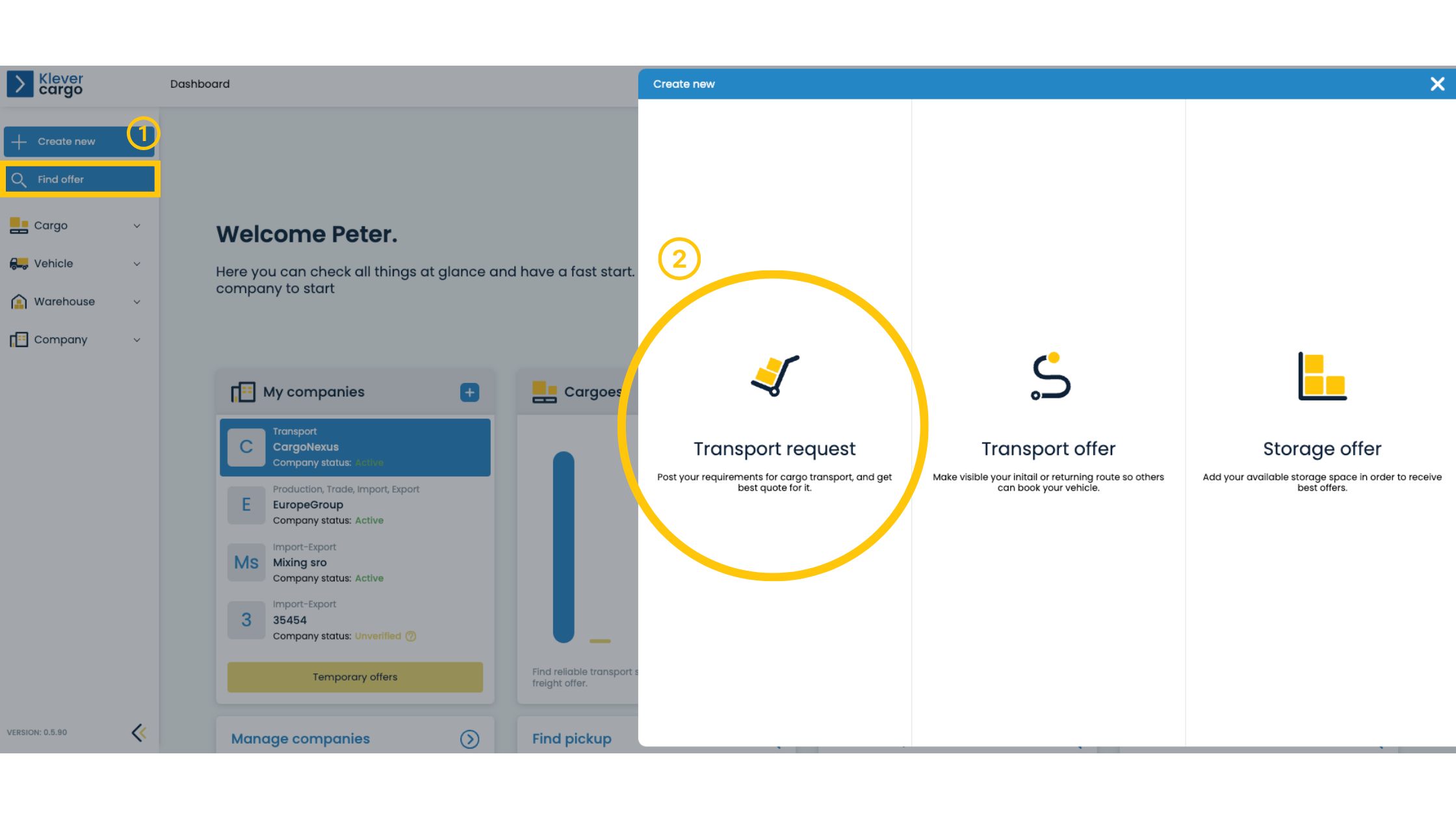

- Posting transport requests:

Once your company gets approved (within 24 hours), you can post transport requests for your goods. Click on +Create new and select Transport request.

Then, provide details such as the type of goods, quantity, origin, destination, and any specific requirements.

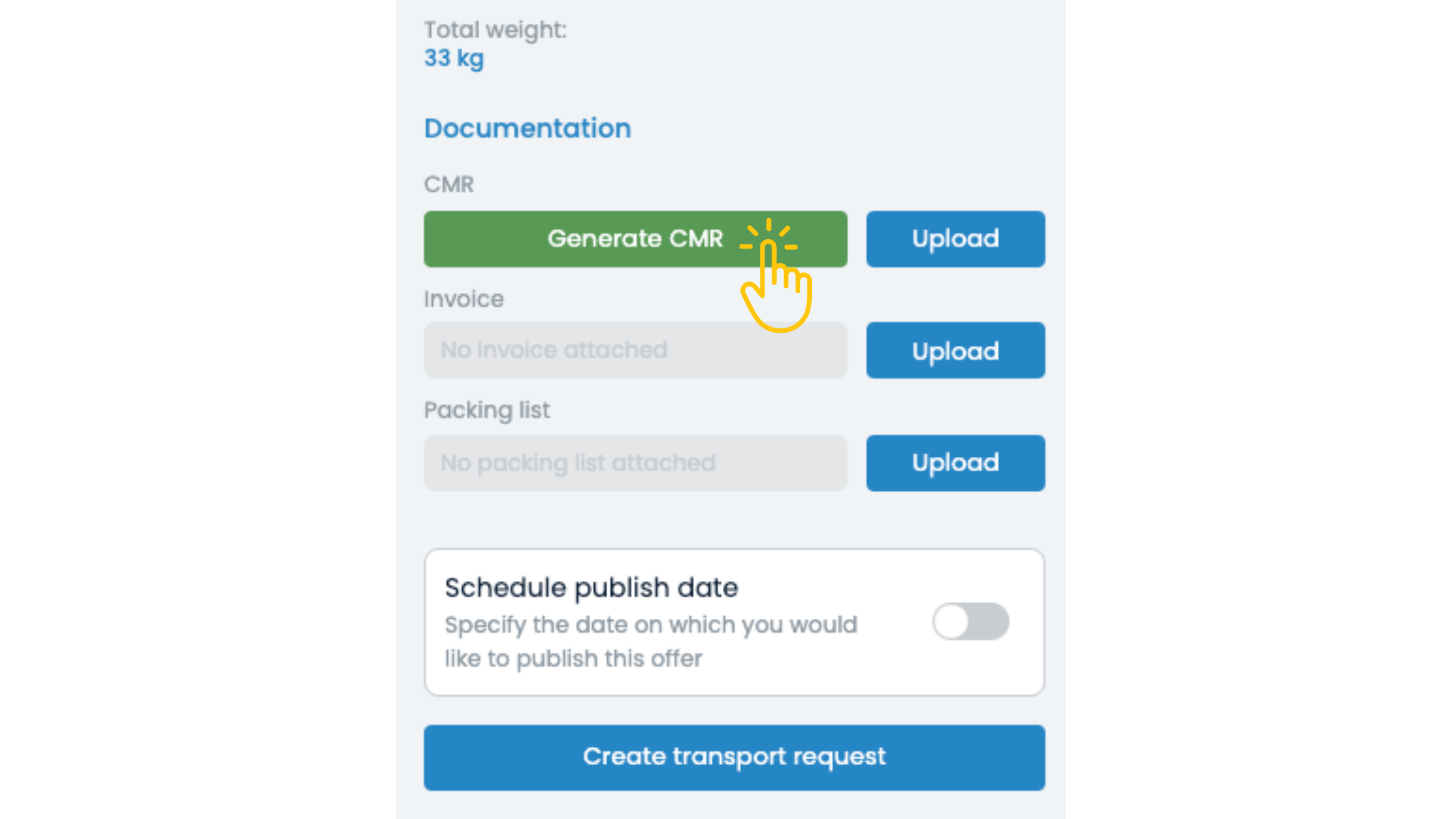

- Automated CMR generation:

The unique feature of KleverCargo is its ability to generate CMR documents automatically.

When you add all the necessary info, the platform will automatically transfer that info to the CMR. That includes the sender, consignee, and goods details.

In summary

CMR insurance is crucial for safe international road transportation. Its goal is to provide financial protection and reduce risks by following the rules. Whether you’re a shipper, carrier, or receiver of goods, CMR insurance is like a safety net.

Platforms like KleverCargo make it even easier with automated CMR document generation. Register on KleverCargo to simplify your logistics and protect your goods during transport.